Corporate Report 2024: Letter from the Management Board | About This Report | Sustainability Management | Corporate Bodies and Management | Report of the Supervisory Board | Turn Challenges into Opportunities | Group Management Report | Products | Safety and Health | Environment | People | Social Commitment | Consolidated Financial Statements (condensed version) | Multi-Year Overview | Global Compact: Communication on Progress (COP) | ALTANA worldwide | List of Shareholdings | Overview | Contact

General Business Setting

Overall Economic Situation

Amid ongoing geopolitical crises, global economic growth in 2024 reached a below-average yet stable level. Following growth of 3.3 % in the previous year, the International Monetary Fund (IMF) currently estimates that global economic output will increase by 3.2 % in 2024. As in previous years, however, developments varied across regions and economies. Inflation rates continued to decline, leading to a gradual easing of monetary policy. However, these measures did not have the same positive effect on stabilizing private consumption and investment activity everywhere. While the availability of raw materials and energy stabilized, price levels remained high.

According to IMF estimates, the economy in the Eurozone remained weak in 2024. Following growth of 0.4 % in the previous year, economic output increased only slightly, by 0.8 %. In Germany, economic output was slightly negative at - 0.2 %, similar to the previous year. While consumption stabilized due to an increase in real incomes, persistent weakness in the manufacturing sector and exports contributed to the downward trend. Growth in other Eurozone countries also remained low, though slightly positive, with Italy at 0.6 % and France at 1.1 %. Spain, with a growth rate of 3.1 %, experienced above-average development compared to the Eurozone.

According to the latest IMF estimates, the economies in the Americas stabilized at a slightly positive level overall in 2024, with inflation continuing to ease. The U.S. achieved growth in gross value added of 2.8 %, while Canada recorded growth of 1.3 %. In the Latin American countries, growth remained on par with the previous year at 2.4 %. Brazil showed a positive trend compared to the previous year, with 3.7 % growth, whereas Mexico experienced a slowdown, with growth falling to 1.8 %. For Argentina, which had already seen a decline in economic output of - 1.6 % the previous year, the IMF predicted a further deterioration, forecasting a decline of - 2.8 %.

As per the IMF, Asia remained the region with the most dynamic economic development in 2024, even though the leading economies of China and India were unable to match the previous year’s growth rates. China, which achieved 5.2 % growth in the previous year, lost some momentum in 2024, with growth forecast at 4.8 %. The ongoing crisis in the real estate sector and a lack of confidence among domestic consumers weighed on economic development. In India, where growth was 8.2 % in the previous year, industrial activity slowed. Nevertheless, it still achieved above-average growth, with an estimated increase in gross value added of 6.5 %, according to the IMF. The ASEAN-5 countries, following a 4.0 % increase in 2024, are forecast to see growth of 4.5 %. Japan, which grew by 1.5 % the previous year, is estimated to have experienced a decline in economic output of - 0.2 %.

Industry Specific Framework Conditions

The American Chemistry Council (ACC) estimates that global chemical production grew by 3.5 % in the past fiscal year (compared to 1.0 % in the previous year). This indicates that the chemical industry performed better than in the previous year and slightly exceeded the estimated overall economic growth for 2024. Demand recovered at varying speeds across different regions.

According to the German Chemical Industry Association (VCI), Germany, Europe’s largest chemical producer, recorded growth of 2 % for the industry as a whole, following a sharp decline in the previous year (- 8 %). Excluding the pharmaceutical sector, the VCI expects a 4 % increase for the past fiscal year (compared to - 11 % the previous year). The industry association ACC forecast growth of 1.9 % for the European market as a whole, marking an improvement after the steep production decline in the previous year (- 8.1 %), which was primarily caused by high energy costs due to the Russian war of aggression against Ukraine.

In the United States, chemical production excluding pharmaceutical products fell by 0.4 % overall, according to the ACC. As a result, it performed below both the overall economic development of the U.S. and the chemical production growth in North America as a whole, where production remained almost at the previous year’s level with a growth of 0.2 %, according to the ACC. In Latin America, the industry was weaker than in North America, with an overall decline of 0.8 %.

According to the ACC, the chemical industry in the Asia-Pacific region grew by 4.8 % in the 2024 fiscal year, demonstrating continued growth momentum following growth of 4.3 % in the previous year.

Due to production cuts and ongoing geopolitical tensions, the price of a barrel of Brent crude oil continued to fluctuate strongly during the year. But with the annual high of 90 U.S. dollars in May 2024, the peaks of recent years were no longer reached. At the end of the year, the price of a barrel of Brent crude fell to 74 U.S. dollars. At 81 U.S. dollars, the average price for the year was on a par with that of the previous year (82 U.S. dollars).

Important Events for Business Development

Non-operating effects impacted ALTANA’s earnings and financial position as well as its net assets in 2024.

Non-operating effects from acquisitions in the 2024 fiscal year stemmed primarily from transactions completed in the previous year. These included the BYK division’s acquisition of Imaginant Inc. in Rochester, New York, on August 15, 2023, and the ELANTAS division’s acquisition of a majority stake in the Swiss Von Roll Group on September 29, 2023. Additionally, the ECKART division acquired the Silberline Group, headquartered in Tamaqua, Pennsylvania, USA, on January 19, 2024.

The fluctuation of key exchange rates for ALTANA against the Group currency, the euro, had a slightly negative impact on sales development in 2024 and, to a lesser extent, on earnings development. The most significant effect came from the change in the euro exchange rate against the Chinese renminbi, which averaged CNY 7.79 for one euro, higher than the previous year’s figure of CNY 7.66 to the euro. Other notable negative effects from exchange-rate fluctuations arose from the Brazilian real, which at BRL 5.83 for one euro was also higher than the previous year (BRL 5.40 to the euro). The Japanese yen followed the same trend, with a ratio of 163.85 JPY for one euro (previous year: 151.99 JPY to the euro), as did the Indian rupee, with a ratio of 90.56 INR for one euro (previous year: 89.30 INR for one euro), and the Mexican peso, with a ratio of 19.83 MXN for one euro (previous year: 19.18 MXN to the euro). The average U.S. dollar exchange rate remained at the same level as the previous year (USD 1.08 for one euro), contributing little to the overall exchange-rate effects. Slightly positive effects in 2024 were mainly due to a weaker Swiss franc exchange rate. The average exchange rate of the euro to the Swiss franc decreased from CHF 0.97 for one euro in 2023 to CHF 0.95 to the euro in 2024. Differences in exchange rates as of the balance sheet date had a net positive effect on balance sheet items compared to the previous year.

Business Performance

Group Sales Performance

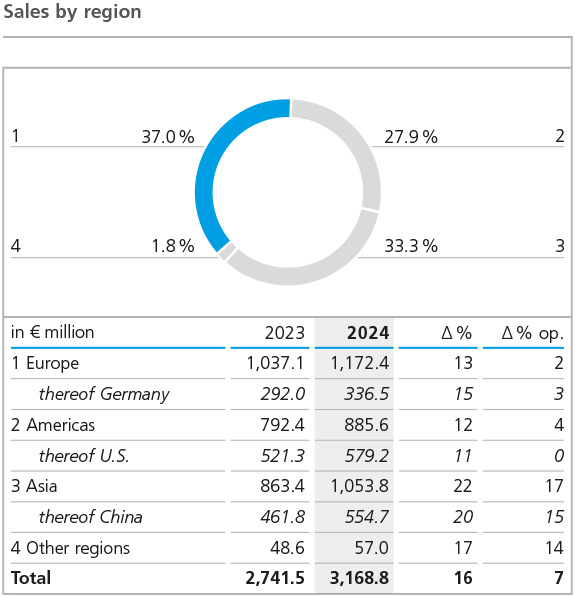

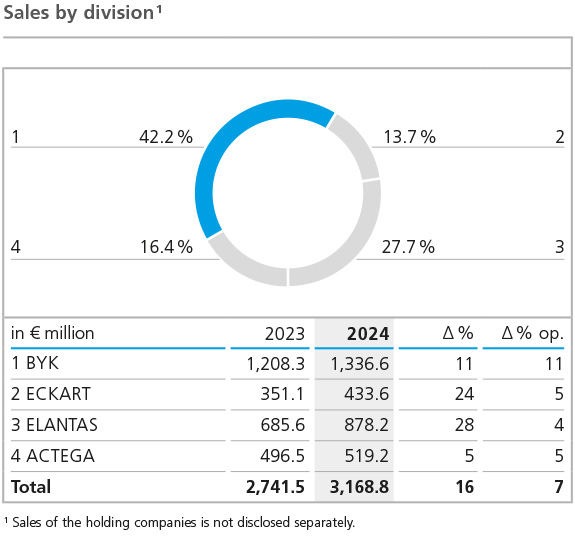

Despite persistently difficult market conditions, ALTANA was able to significantly improve sales in 2024 over the previous year, both nominally and adjusted for non-operating effects. Group sales reached a total of € 3,168.8 million and thus increased by 16 % or € 427.3 million compared to 2023 (€ 2,741.5 million). Non-operating effects had a positive impact on the overall sales trend. Although the aforementioned exchange-rate fluctuations resulted in a slight decrease of € 20.8 million from the translation of foreign currency sales, the acquisitions boosted sales by a total of € 244.7 million, mainly due to the acquisition of the Von Roll Group (€ 173.8 million) in September 2023, which was integrated into the ELANTAS division. The Silberline Group, which was acquired for the ECKART division in January 2024, contributed € 64.9 million to total sales, while the business activities of Imaginant Inc., based in Rochester, New York, acquired for the BYK division in August 2023, generated additional sales growth of € 6.0 million. The effects were calculated based on the duration of the Group affiliation. Adjusted for the positive acquisition effects and negative exchange-rate effects, operating sales growth was 7 % above the previous year and therefore exceeded the strategic target of 5 %.

Already at the beginning of 2024, demand for our products developed slightly better than planned. This trend continued throughout the year, resulting in nominal sales growth of 11 % in a year-to-year comparison. Adjusted for non-operating effects from acquisitions, volume growth amounted to 9 %. The slightly lower raw-material prices in 2024, compared to the previous year, led to reductions in our sales prices in certain product segments, which had a slightly negative impact on operating sales development, in addition to changes in the product mix. Overall, however, not only was there a significant increase in sales and turnover compared to 2023, but the sales growth expectations for 2024 were also exceeded in the mid-single-digit percentage range in operational terms.

The positive sales trend was evident across all regions, albeit with varying intensity due to the specific conditions in each sales region. As a result, there were slight shifts in the regional sales and turnover structure. With a 37 % share of total Group sales (compared to 38 % in the previous year), Europe remained the most important region for ALTANA. It recorded sales growth of 13 %, with an increase of 2 % when adjusted for acquisitions and exchange-rate effects. Germany, the market with the highest sales, grew by 3 % compared to the previous year, adjusted for non-operating effects. Other Eurozone countries also saw growth, while operating sales declined only in a few Western European countries and in Poland.

Sales in the Americas exceeded the previous year’s figure by 12 % in 2024, with a 4 % increase when adjusted for exchange-rate and acquisition effects. In operational terms, U.S. sales remained at the previous year’s level. The country’s share of the Group’s total sales fell slightly to 18 % in 2024, from 19 % in the previous year. However, as in 2023, the U.S. remained the Group’s strongest single market in terms of sales. Sales also increased in all other countries in the region, with some experiencing double-digit growth. Brazil saw a 14 % increase in operational terms, followed by Mexico with 7 % and Canada with 4 %. The Americas’ share of Group sales decreased slightly to 28 % in 2024, from 29 % in the previous year.

In the past fiscal year, Asia once again increased its share of total Group sales, rising from 31 % to 33 %. The region recorded the strongest nominal and operational sales growth within the Group. Growth amounted to 22 % in nominal terms and 17 % in operational terms, adjusted for negative exchange-rate and acquisition effects. The main drivers of this development were China and India, the region’s most important markets. With operating growth of 15 %, China made up for the previous year’s sales decline and also recorded growth. Its share of the Group’s total sales rose again from 17 % to 18 %. India even surpassed the exceptional growth of the previous year, recording operating growth of 13 %. The Southeast Asia region, South Korea, and the Middle East countries also saw significantly higher sales figures.

Sales Performance of BYK

The BYK division’s sales increased by 11 %, or € 128.3 million, reaching € 1,336.6 million in the 2024 fiscal year, compared to € 1,208.3 million the year before. This included negative exchange-rate effects of € 8.5 million and positive effects of € 6.0 million from the acquisition of the business activities of Imaginant Inc., based in Rochester, New York, on August 15, 2023. These effects resulted in only a slight non-operating deviation, meaning that an 11 % increase in sales was also achieved in operational terms.

Despite the challenging market environment, the division was able to nearly offset the previous year’s decline in sales. The growth was primarily driven by an increase in sales volumes, while price and mix effects played a lesser role. The growth impacted nearly all product lines in the additives product area, particularly those for paints and coatings. Additionally, further growth was achieved in the instruments business.

All regions contributed to the growth in 2024, though at different rates. Asia was by far the leading region in terms of sales development, surpassing Europe as the region with the highest sales. This growth was driven by the markets in China and India, which saw double-digit percentage growth in sales after adjusting for exchange-rate effects. Significant expansion was also achieved in other Asian markets. Adjusted for exchange-rate and acquisition effects, Europe experienced mid-single-digit percentage sales growth in 2024 but continued to lose momentum in Germany, the market with the highest sales. The overall positive development was mainly driven by growth in other Eurozone countries, such as Italy and Spain, as well as in markets like Poland, Eastern Europe, and Turkey. The Americas region showed positive overall development, achieving operating growth in the mid-single-digit percentage range, although the U.S., the market with the highest sales, only grew by a low single-digit percentage after adjusting for non-operating effects. The most dynamic markets in this region were Mexico and Brazil, with operating growth rates in the double-digit percentage range.

Sales Performance of ECKART

The ECKART division generated sales of € 433.6 million in 2024 (previous year: € 351.1 million). The year-on-year growth of 24 % was mainly influenced by the acquisition of the Silberline Group, headquartered in Tamaqua, Pennsylvania, USA, on January 19, 2024. Exchange-rate effects had a slightly negative impact. Operating growth amounted to 5 % and was largely driven by positive price and mix effects. Adjusted for acquisition effects, the development of sales volume was slightly negative.

Sales performance in 2024 was mixed at the regional level. Europe, the region with the highest sales, saw a mid-single-digit percentage increase when adjusted for exchange-rate and acquisition effects, with Germany, the leading market, achieving double-digit growth. Asia experienced a significant boost in momentum, recording double-digit operating growth, driven primarily by China, the largest market in terms of sales, as well as India and Thailand. South Korea and Japan also saw operating growth. While the Americas grew overall due to the acquisition of the Silberline Group, the operating sales trend was negative. Adjusted for currency and acquisition effects, sales in this region declined by a low single-digit percentage, with the U.S., the largest market in terms of sales, experiencing a notable loss in the mid-single-digit range. In contrast, other markets in the region, particularly Brazil, along with Mexico and Canada, achieved double-digit percentage operating growth.

Sales Performance of ELANTAS

In the ELANTAS division, sales in 2024 increased by 28 % or € 192.6 million to € 878.2 million (previous year: € 685.7 million), primarily driven by positive effects from the acquisition of the Von Roll Group in the previous year, amounting to € 173.8 million in 2024. Operating sales growth, adjusted for the positive acquisition effects and negative exchange-rate effects of € 6.9 million, was 4 %. In 2024, ELANTAS recorded positive operating sales development in the upper single-digit percentage range. However, the resulting sales growth was partially offset by negative price effects.

The sales performance across regions in the ELANTAS division presented a heterogeneous picture. Adjusted for exchange-rate and acquisition effects, the Asia region demonstrated strong momentum, achieving double-digit percent-age growth. This positive development was primarily driven by China, the market with the highest sales. India also continued to show operating growth in the high single-digit percentage range. In contrast, Europe experienced a decline in operating sales, down in the mid-single-digit percentage range. Both Italy and Germany, the largest markets, saw a decrease in operating sales, while some Eurozone countries and Eastern Europe achieved positive growth in percentage terms. In nominal terms, the ELANTAS division achieved a significant increase in sales, particularly in this region, due to the acquisition of the Von Roll Group. The performance in the Americas was also positive in nominal terms, but when adjusted for currency and acquisition effects, the region recorded a slight loss in sales in the low single-digit percentage range. The leading market, the USA, along with Canada and Mexico, experienced a decline in operating sales, while Brazil and other markets in the Americas showed positive operating growth.

Sales Performance of ACTEGA

With sales of € 519.2 million (previous year: € 496.5 million), the ACTEGA division achieved a 5 % increase in sales compared to 2023. Operating sales development remained stable, with only minor negative currency effects of € 4.2 million. Volume sales performed significantly more positively in this division, showing growth of 9 %. However, price reductions due to lower raw-material prices slightly tempered the overall growth.

The division’s sales performance was positive across all regions in 2024, though the momentum varied between them. Europe, the region with the highest sales, saw operating sales growth in the mid-single-digit percentage range. Germany, the largest European market, and Italy both recorded increases in operating sales, while France experienced slight losses. The Netherlands and Turkey stood out in the Europe region, achieving double-digit percentage growth in operating sales. In the Americas, sales increased across all markets in 2024, with overall growth in the mid-single-digit percentage range after adjusting for exchange-rate effects. The U.S., the region’s largest market in terms of sales, recorded only moderate growth in the low single-digit percentage range, while Brazil saw growth in the mid-single-digit percentage range. Mexico achieved the highest growth in the region, with double-digit percentage increases. The Asia region showed the greatest momentum for the ACTEGA division, with operating sales growth in the double-digit percentage range. This was primarily driven by expansion in the markets of Thailand and India, while China, the largest market, saw only moderate operating growth in the mid-single-digit percentage range.

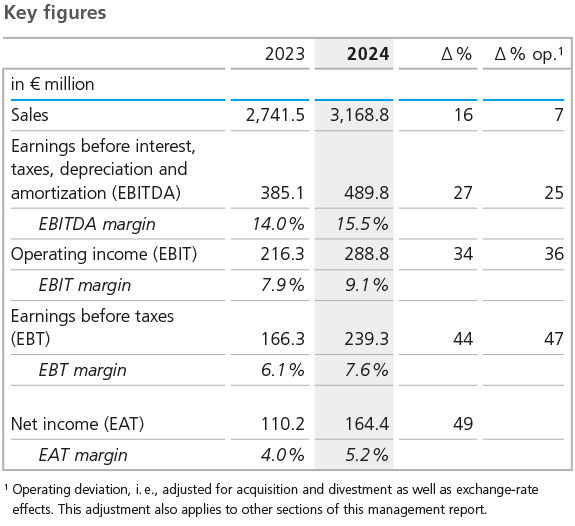

Earnings Situation

We significantly improved our earnings position in 2024 compared to the previous year, primarily driven by a substantial increase in demand for our products. The cost of materials, measured against sales, continued to decrease slightly compared to the previous year. Combined with the increased sales volume, this led to a significantly positive development in contribution margins compared to 2023. In addition to tariff increases and higher variable sales costs, operating costs were impacted by significant one-time effects, including costs related to the integration of acquired companies. Thanks to the positive development of the contribution margin, absolute earnings before interest, taxes, depreciation, and amortization (EBITDA) rose by 27 %, or € 104.7 million, reaching € 489.8 million – a notable increase from the previous year’s € 385.1 million. Adjusted for acquisition and exchange-rate effects, operating earnings growth amounted to 25 %. At 15.5 %, the EBITDA margin was higher than the previous year’s 14.0 %, though, as expected, it remained below our strategic target range of 18 % to 20 %. This not only significantly exceeded last year’s figures, but also surpassed the targets set for 2024 for both absolute EBITDA development and further improvement of the EBITDA margin.

Variable raw-material and packaging costs remain the most significant cost factor for ALTANA. The material cost ratio, these costs relative to sales, was already below the previous year’s level at the start of 2024 and maintained this trend throughout the year. In the first quarter, the material cost ratio started at 42.6 %, and, after slight fluctuations, it reached 44.3 % by the fourth quarter. For the full year 2024, the material cost ratio stood at 43.3 %, a decrease from the previous year’s 46.5 % and lower than our initial forecast. The trend in material costs was positive across all four divisions, with the ELANTAS and BYK divisions showing the most significant year-on-year reduction in the material cost ratio.

The level and structure of cost development in 2024 were primarily influenced by the acquisitions made in 2023 and 2024. While inflation continued to fall slightly, costs remained at a high level. Personnel costs saw a double-digit percentage increase in nominal terms compared to the previous year, with a significant portion of the rise attributed to the addition of employees from the acquisitions of the Von Roll Group and the Silberline Group. The operational increase was mainly driven by higher salaries and wages. As a result, the ratio of total personnel costs to sales increased slightly to 23.5 % (previous year: 22.7 %).

Within production costs, personnel costs were notably higher than the previous year, primarily due to the increase in staff from the acquisition of the Von Roll Group and the Silberline Group. Energy costs and other variable cost components also rose, reflecting the positive operational development and higher volume of production compared to the previous year.

The absolute increase in selling expenses is partly due to the takeover of the acquired companies’ distribution activities, but also to the operational increase in volumes sold. Freight costs and other volume-related costs such as sales bonuses rose significantly in absolute terms.

In 2024, ALTANA once again increased its research and development expenditures. This increase was mainly driven by the integration of the R&D activities of the acquired companies, as well as a rise in personnel expenses. Despite the higher spending, the relative share of R&D costs to total sales decreased from 7.2 % to 6.7 %, due to the significant increase in sales. Nevertheless, the ratio remained within our target range of around 7 %.

Administrative expenses saw the largest increase compared to the previous year, primarily driven by the ELANTAS and ECKART divisions. The main contributing factors were integration costs related to the recent acquisitions and the transfer of employees from the acquired companies. Additionally, salary and wage increases across all divisions added to the growth in personnel costs. As a result, the ratio of administrative costs to sales climbed to 5.6 %, up from 5.2 % in the previous year.

The other operating result was negatively impacted by expenses for real estate transfer tax amounting to € 20.5 million at German companies, due to the transfer of shares in SKion GmbH, as well as extraordinary write-downs on assets held for sale totaling € 19.4 million. However, insurance reimbursements related to an incident in 2023 at a site in Germany, amounting to € 36.5 million, had a positive effect on the other operating result. As a consequence, earnings before interest and taxes (EBIT) amounted to € 288.8 million, reflecting a 36.4 % increase compared to the previous year (€ 216.3 million).

At € - 17.1 million, the financial result was lower than the previous year’s € - 7.1 million. Net interest deteriorated in 2024, primarily due to the interest expense from the € 180 million promissory note loan drawn down in November 2023. During the fiscal year, loans with conversion options were sold, and an issued loan was impaired due to payment default risks. The earnings effects of these two items largely offset each other in the financial result. The result from companies accounted for using the equity method improved from € - 43.0 million in the previous year to € - 32.4 million in 2024. An additional € - 37.7 million was recognized off balance sheet due to a limited allocation of losses.

Earnings before taxes (EBT) increased to € 239.3 million (previous year: € 166.3 million), while earnings after taxes (EAT) rose to € 164.4 million (previous year: € 110.2 million). The effective tax rate, adjusted for earnings from companies accounted for using the equity method, stood at 27.6 %, slightly higher than the previous year’s rate of 26.8 %.

Asset and Financial Situation

Capital Expenditure

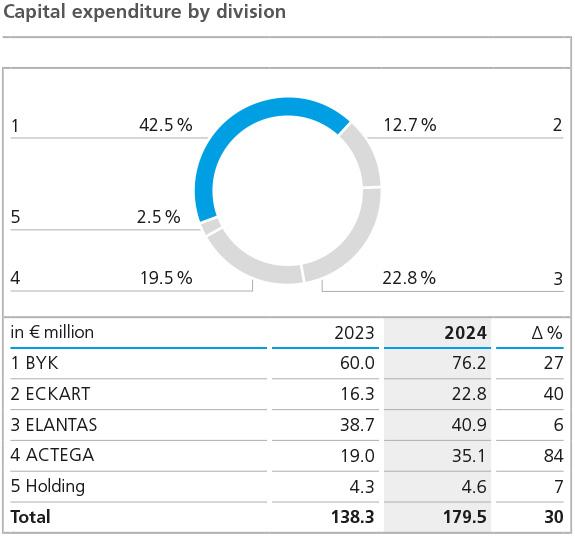

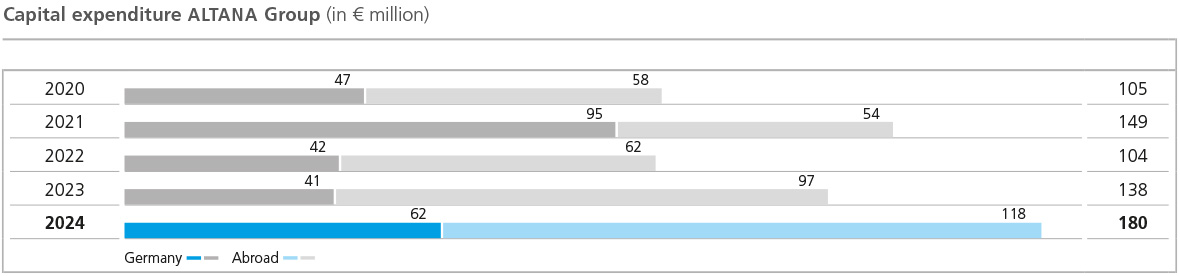

In the past fiscal year, ALTANA invested a total of € 179.5 million in intangible assets and property, plant and equipment. Capital expenditure thus exceeded the previous year’s figure (€ 138.3 million). At 5.7 %, the investment ratio, that is the ratio of investments to sales, was within our long-term target range of 5 % to 6 %.

Total investments amounted to € 179.5 million, with € 158.9 million allocated to property, plant, and equipment (previous year: € 122.7 million). For several years, major projects have been underway to strategically expand regional production and laboratory capacities. Investments in intangible assets totaled € 20.6 million in 2024, up from € 15.6 million in 2023, primarily focused on advancing digitalization and ERP systems.

There were project-related shifts in the regional distribution of investments compared to the previous year. Europe’s share increased from 50 % in 2023 to 54 % in the reporting year. Asia’s share remained unchanged at 16 %, while the Americas’ share saw a significant decrease, dropping to 29 % of the total volume (from 34 % in 2023).

In 2024, the BYK division invested a total of € 76.2 million, a significant increase compared to the previous year (€ 60.0 million). The main focus of these investments was the further expansion of production capacities in the U.S., Germany, and the Netherlands. Additionally, investments were made in research and development capacities, as well as strategic digitalization projects.

In 2024, the ECKART division’s investment volume amounted to € 22.8 million, higher than the previous year’s € 16.3 million. As in the previous year, most of the investment was directed towards the division’s site in Hartenstein and its sites in the U.S. Additionally, a significant portion of the investment was allocated to measures at sites of the newly acquired Silberline Group.

In 2024, the ELANTAS division increased its investments in property, plant and equipment, as well as intangible assets, to € 40.9 million, compared to € 38.7 million in the previous year. The division’s investments were primarily focused on acquiring land for future production expansion in India, upgrading production facilities at the Zhuhai site in China, and enhancing the Von Roll site in Switzerland.

Investments in the ACTEGA division amounted to € 35.1 million (previous year: € 19.0 million). Investments in the past fiscal year mainly related to digitization and the new site in North Carolina in the United States.

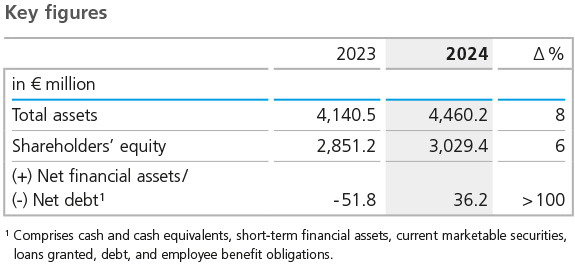

Balance Sheet Structure

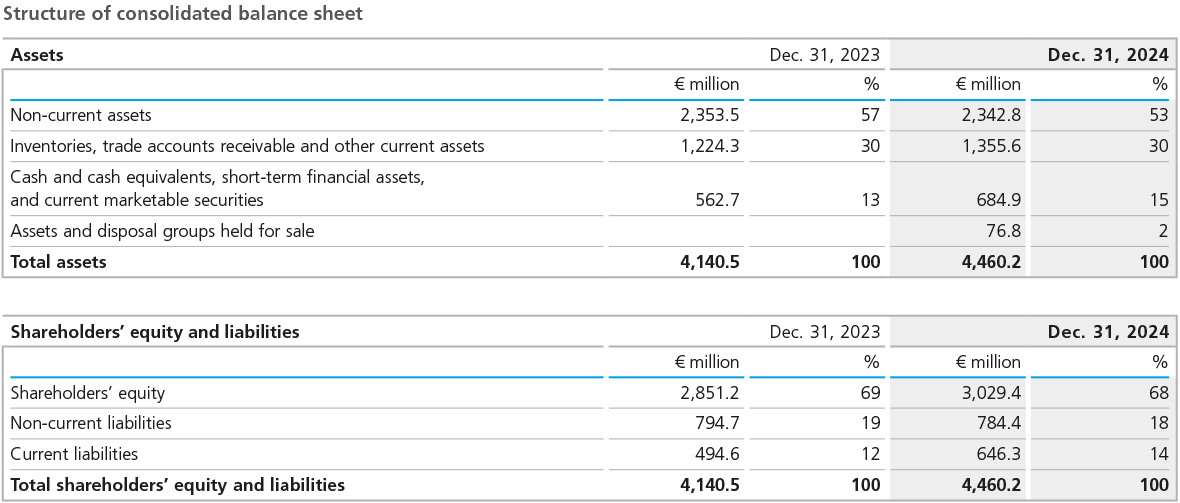

At the end of 2024, the ALTANA Group’s balance sheet structure changed due to the inclusion of the Silberline Group in the scope of consolidation, as well as developments from ongoing business activities. Total assets increased from € 4,140.5 million in the previous year to € 4,460.2 million in 2024, marking a rise of € 319.7 million, or 8 %. This growth was mainly driven by an increase in current assets, with positive exchange-rate effects also impacting the balance sheet total. For the presentation of assets and disposal groups held for sale, reclassifications were made across various balance sheet items in accordance with IFRS 5.

Intangible assets decreased slightly to € 1,025.9 million (previous year: € 1,033.8 million). But property, plant and equipment saw an increase, rising from € 1,147.0 million in the previous year to € 1,219.9 million. Investments in property, plant and equipment amounted to € 158.9 million, surpassing depreciation and amortization of € 124.0 million. Positive exchange-rate effects also contributed to the increase in the carrying amounts in the Group currency, the euro, in both areas. The change in long-term financial investments results from the sale of loans with conversion options as well as the reclassification of issued loans into short-term assets.

Total non-current assets amounted to € 2,342.8 million as of the reporting date (previous year: € 2,353.5 million), reflecting a decrease of € 10.7 million compared to the previous year. Their share of the total balance sheet fell to 53 % (previous year: 57 %).

The change in current assets was mainly due to the increase in net working capital items, short-term financial assets, and cash and cash equivalents. Inventories rose to € 626.5 million (previous year: € 561.8 million), driven partly by the inclusion of the Silberline Group in the scope of consolidation, as well as increased business activity. Similarly, trade receivables increased, reaching € 548.5 million, compared to € 505.8 million in the previous year. At € 917.3 million, the scope of net working capital and current trade payables surpassed the level at the end of 2023 (€ 853.1 million). The range of net working capital relative to the business performance of the preceding three months increased slightly to 135 days, up from 132 days at the end of 2023. The absolute value of net working capital at the end of 2024 exceeded the forecast, partly due to the acquisition of the Silberline Group. The anticipated decline in the reach was not achieved due to these developments. Cash and cash equivalents increased to € 558.2 million (previous year: € 491.3 million), largely due to the positive performance of business activities and profitability. As a result, total current assets rose significantly to € 2,117.4 million (previous year: € 1,787.0 million).

On the liabilities side, changes resulted primarily from improvements in equity due to the positive result after taxes, increases in current liabilities, and exchange rate-related adjustments. The Group’s equity rose by € 178.2 million, or 6 %, to € 3,029.4 million (previous year: € 2,851.2 million). A dividend of € 40 million was distributed in 2024. As of December 31, 2024, the equity ratio remained stable at 68 %, comparable to the previous year’s ratio of 69 %.

Total non-current liabilities decreased by € 5.0 million during 2024, primarily due to the repayment of non-current liabilities. As a result, non-current liabilities saw a slight decrease of € 10.3 million, totaling € 784.4 million (previous year: € 794.7 million).

The total current liabilities reported on the balance sheet as of December 31, 2024, saw a significant increase, rising from € 494.6 million to € 646.3 million. This increase was driven by notable growth in trade payables, current tax provisions, and other provisions.

As of December 31, 2024, the balance of cash and cash equivalents, current financial assets, short-term securities, loans issued, financial liabilities, and employee benefit obligations resulted in net financial assets of € 36.2 million. This represents an improvement of € 88.1 million compared to the previous year, when net financial debt stood at € 51.8 million, primarily driven by the increase in cash and cash equivalents.

Principles and Goals of Our Financing Strategy

The financing of operating activities should generally be covered by the cash flow generated from these activities. The same applies to investment requirements that serve the continuous expansion of business activities.

Based on this, the objectives of our financing strategy are geared, on the one hand, to keeping the cash and cash equivalents generated in the Group centrally available. On the other hand, we strive for a financial framework that enables ALTANA to handle acquisitions and large investment projects that go beyond the usual scope flexibly and quickly.

To successfully implement these goals, we manage nearly all the Group’s internal financing centrally via ALTANA AG. To this end, cash pools are set up for the important currency areas.

In June 2021, ALTANA restructured its long-term Group financing: Since June 2021, ALTANA has had access to € 250.0 million in the form of a syndicated credit facility from an international bank consortium which has a minimum term until 2026. In 2023, the term was extended until 2028. This credit line had not been utilized as of December 31, 2024. In addition, ALTANA has had access to loans from the European Investment Bank (EIB) of up to € 200.0 million since the end of June 2021 for the development of climate-friendly, digital, and sustainable products. In the 2022 fiscal year, the EIB loan commitment was increased by € 50 million to a total of € 250 million and the call period was extended by one year until December 21, 2023. The EIB loans were utilized in the amount of € 210.0 million by the end of the call period in 2023; in 2024, principal payments of € 5 million were made. In November 2023, ALTANA issued a promissory note loan with a sustainability component of € 180 million with a minimum term until 2026. The promissory note is divided into tranches with different terms of between three and seven years, which have both variable and fixed interest rates.

This financing structure provides ALTANA with the flexibility needed to capitalize on short-term and investment-heavy growth opportunities. The maturity distribution of the existing financing instruments allows us to efficiently manage liability repayments through inflows from operating cash flow.

Off-balance-sheet financing obligations arise from bank guarantees, purchase commitments, and guarantees related to employee benefit obligations. Further details regarding the existing financing instruments are provided in the Consolidated Financial Statements.

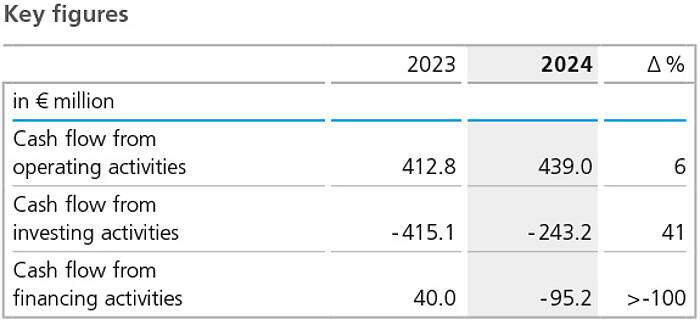

Liquidity Analysis

In 2024, cash and cash equivalents rose by € 66.9 million to € 558.2 million (previous year: € 491.3 million), with a reduction of € 36.6 million due to the reclassification of cash and cash equivalents to assets held for sale. The cash inflow from operating activities amounted to € 439.0 million, exceeding the previous year’s figure of € 412.8 million and aligning with our expectations. This positive result was primarily driven by the increase in earnings after taxes and non-cash expenses related to the rise in current provisions. However, this was partially offset by the liquidity tied up in net working capital, especially in inventories.

The cash outflow from investing activities decreased in 2024, totaling € 243.2 million compared to € 415.1 million in the previous year. The outflow included € 45.6 million for the acquisition of the Silberline Group, which was significantly lower than the € 223.4 million spent in the previous year for the Von Roll Group acquisition. Investments in intangible assets and property plant and equipment were higher than the previous year’s level.

Cash outflow from financing activities amounted to € 95.2 million in the 2024 fiscal year, primarily due to the repayment of non-current and current liabilities, mainlythose reported by a company in the Silberline Group at the time of its acquisition. In addition, ALTANA AG paid a dividend of € 40.0 million in 2024 (compared to € 150.0 million in the previous year). In contrast, the previous year saw an inflow of funds from financing activities amounting to € 40 million.

Value Management

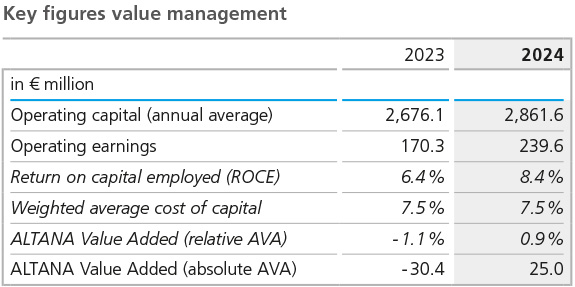

ALTANA determines the change in the company’s value via the key figure ALTANA Value Added (AVA), whose calculation is explained in the “Group Basics” section. In addition, the key figure Return on Capital Employed (ROCE), which is also presented in the “Group Basics” chapter, is used to measure the development of the company’s value.

In the 2024 fiscal year, a positive contribution to the development of the company’s value was again achieved, driven by the significantly improved earnings situation. However, this was somewhat offset by a considerable increase in the average operating capital tied up in the Group, primarily due to the acquisitions made.

The average operating capital tied up in the Group increased by 7.0 % in year-to-year terms, reaching € 2,861.6 million (previous year: € 2,676.1 million). This rise is primarily attributed to the inclusion of the Von Roll Group, and to a lesser extent, the acquisition of Imaginant Inc. and the pro-rata consolidation of the Silberline Group in 2024. The increase was largely due to higher investments in property, plant and equipment, as well as intangible assets.

ALTANA’s positive earnings performance in 2024 was reflected in operating income after taxes, which amounted to € 239.6 million (previous year: € 170.3 million). The EBIT development, combined with a slightly improved effective tax rate of 25.7 % (previous year: 26.8 %), adjusted for significant special effects, contributed to an overall improvement in the earnings base relative to operating capital. The application of an unchanged cost of capital rate of 7.5 % resulted in a cost of capital of € 214.6 million (previous year: € 200.7 million).

In 2024, the return on capital employed (ROCE) reached 8.4 %, an increase from the previous year’s figure of 6.4 %. The absolute value added (AVA) amounted to € 25.0 million, a significant improvement compared to € - 30.4 million in the previous year. The relative AVA also improved, rising from - 1.1 % in 2023 to 0.9 % in 2024.

Thanks to the improved earnings situation in 2024, the expectations regarding the development of the value management key figures were exceeded. Despite the increase in average operating capital tied up in the Group due to the acquisition of the Silberline Group, a clearly positive result was achieved. In addition, the development of ROCE surpassed expectations.