Letter from the Management Board | About This Report | Sustainability Management | Corporate Bodies and Management | Report of the Supervisory Board | Climate Protection at ALTANA | Group Management Report | Products | Safety and Health | Environment | Human Resources | Social Commitment | Consolidated Financial Statements (condensed version) | Multi-Year Overview | Global Compact: Communication on Progress (COP) | ALTANA worldwide | List of Full Ownership | Overview - About This Report | Contact

General Business Setting

Overall Economic Situation

Following the coronavirus pandemic-related declines in economic output in 2020, 2021 was characterized by an exceptionally strong demand-driven economic development. The International Monetary Fund (IMF) currently estimates that global economic output will increase by 5.9% in 2021. The recovery of the global economy, which was already becoming apparent at the end of 2020, continued over the course of the year at roughly the level forecast for 2021. Despite recurring waves of infection, renewed comprehensive lockdown measures with a massive impact on the industry were largely averted through the use of newly developed vaccines and expanded testing capacities. However, as a result of the sharp increase in demand, energy and raw material prices rose significantly in the course of the year. A shortage of services and transport capacity in the logistics sector had an additional negative effect on global supply chains and the development of economic performance in individual economies. All countries achieved solid to high growth rates in 2021. As a result, many regions reached or exceeded the pre-crisis level of their economic performance. But at the end of the year the economy weakened again somewhat due to ongoing price increases and the emergence of new coronavirus variants.

According to IMF estimates, the Eurozone achieved 5.2% growth in 2021. As a result, the decrease in economic output in the previous year (-6.4%) would be only partially offset. No country was able to fully compensate for the crisis-induced slump. Despite good demand, growth in the Eurozone slowed. The main reasons for this, particularly in the second half of the year, were the sharp rise in energy prices and the sustained disruption of supply chains. In addition, the emergence of new waves of infections led to renewed restrictions on public life, thus putting a burden on economic activity. In Germany, the IMF estimates that economic output grew by 2.7%, following a decline of 4.6% in the previous year.

According to current IMF estimates, the economies of the Americas developed positively overall in 2021, albeit with slight differences. While the U.S. exceeded its pre-crisis level with growth in gross value added of 5.6%, Canada did not with growth of 4.7%. The Latin American countries grew by 6.8% overall, roughly offsetting the previous year’s decline. According to the IMF, Brazil achieved growth of 4.7%, more than compensating for the pandemicrelated losses.

According to the IMF, Asia was also able to achieve an overall increase in gross domestic product in 2021, but here too with varying intensity. China, which posted growth of 2.3% in the previous year, closed 2021 with a growth rate of 8.1%. India, which incurred severe losses in 2020 (-7.3%), grew by 9.0%. According to IMF estimates, growth was lower in the largest economies of Southeast Asia. The IMF anticipates that the countries of the ASEAN 5 group achieved overall growth of 3.1%. Japan’s growth is estimated at only 1.6%.

Industry-Specific Framework Conditions

The American Chemistry Council (ACC) estimates that global chemical production grew by 5.8% in the past fiscal year (previous year: -0.2%). This development corresponds to the overall economic growth in 2021, but was not reflected equally in all regions.

According to estimates by the German Chemical Industry Association (VCI), Germany, Europe’s largest chemical producer, recorded growth of 5.2% for the industry as a whole. Excluding the share of the pharmaceutical sector, slightly lower growth is expected for the past fiscal year (VCI: 4.9%). High growth rates were also reported in other Eurozone countries, such as Italy (VCI: 7.6%) and France (VCI: 6.0%). In the United Kingdom, on the other hand, the industry achieved only slight growth (VCI: 2.0%). Overall, according to the ACC, growth in the industry in Western Europe was slightly below the global average at 5.3% and in Eastern Europe (including Russia) slightly above it at 5.9%.

In the U.S., overall chemical production increased by only 1.4%, according to the ACC. Unexpectedly severe winter conditions in February and other weather-related influences led to production losses that hit the chemical industry particularly hard. In Latin America, however, the industry performed better, with an overall increase of 4.9%.

According to the ACC, the chemical industry in the AsiaPacific region recorded the world’s highest growth in the 2021 fiscal year, at 8.2%. In keeping with the overall economic development, China, the largest producer, was also largely responsible for this development with 8.4% growth (VCI). India also achieved strong growth, at 7.7% (VCI), and was thus able to offset the high pandemic-related plunge in production output in 2020. In Japan, on the other hand, industry growth was much lower (3.7%), according to the VCI.

The global increase in demand already seen in the fourth quarter of 2020 and the subsequent rise in industrial production became increasingly noticeable in the course of 2021. As a result, the price of a barrel of Brent crude oil rose continuously in the months from January to July 2021. From an initial 55 U.S. dollars, the price increased to as much as 75 U.S. dollars by July 2021. After a slight price correction in August and September, the price per barrel reached 84 U.S. dollars in October 2021, before falling back to a level of 74 U.S. dollars at the end of the year. The average price for the year (71 U.S. dollars) was therefore significantly higher than the previous year’s level of 42 U.S. dollars.

Important Events for Business Development

In 2021, non-operating effects at ALTANA influenced the company’s earnings and financial position as well as its assets.

The ECKART division acquired the business activities of TLS Technik GmbH & Co. Spezialpulver KG in Bitterfeld, Germany, on February 1, 2021, thereby expanding its portfolio in industrial, metal-based 3D printing. Its sales development was positively influenced by the acquisition, while its earnings situation was slightly burdened. The ACTEGA division acquired the Henkel company’s closure materials business on May 7, 2021, and was thus able to further expand its business with sealing compounds for the packaging industry. The acquisition had a positive effect on both sales and earnings.

In 2021, the development of the exchange rates between the euro, the Group currency, and other currencies important for ALTANA had a negative effect on the sales development and, to a lesser extent, on the earnings development. The exchange rate of the euro to the U.S. dollar had the greatest impact in 2021. At an average of 1.18 U.S. dollars for one euro, it was higher than in the previous year (1.14 U.S. dollars for one euro). Further significant negative effects from changed exchange-rate relations resulted from the rate of the Japanese yen to the euro, which at 129.88 yen for one euro was also higher than in the previous year (121.85 yen for one euro). By contrast, the average exchange rate of the euro against the Chinese renminbi fell from 7.87 renminbi for one euro to 7.63 renminbi for one euro in 2021, and therefore had a positive impact on sales and earnings. In addition, differences in exchange rates on the balance sheet date had a positive influence on balance sheet items compared to the previous year.

Business Performance

Group Sales Performance

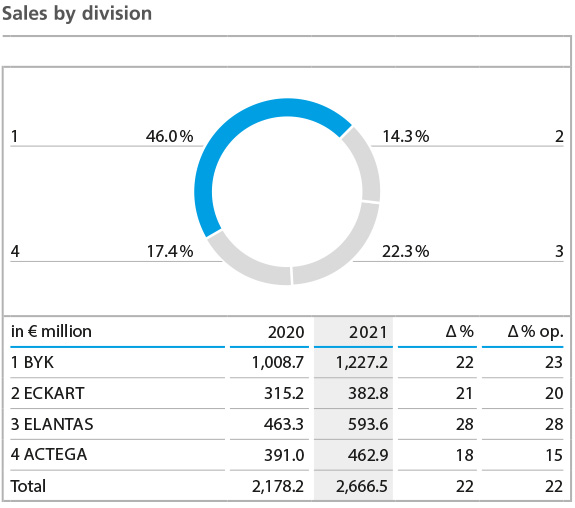

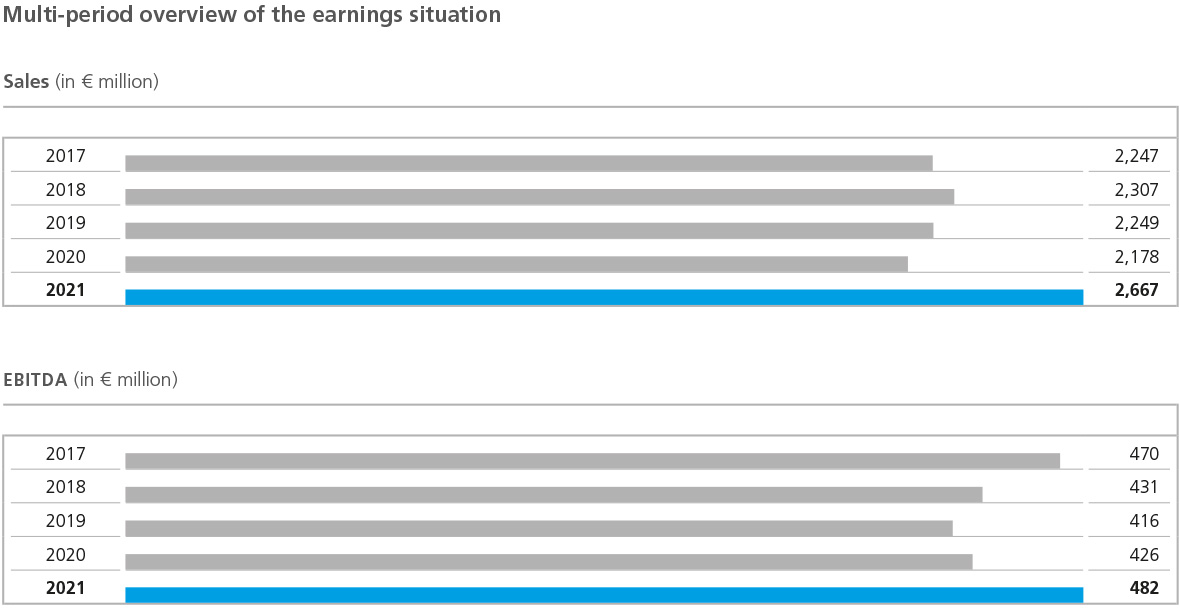

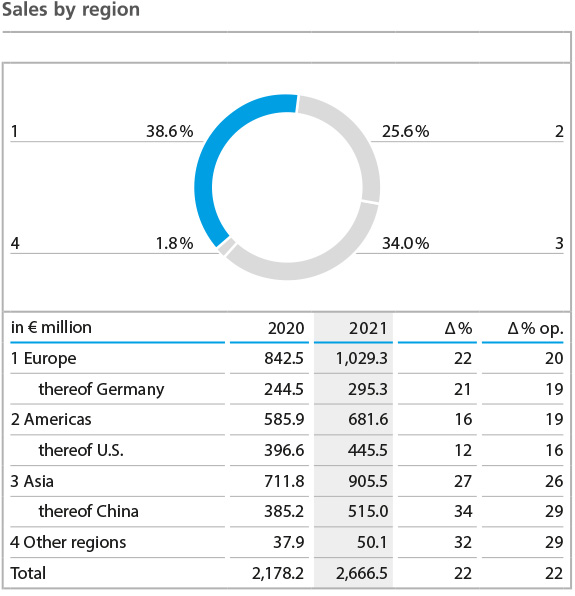

Group sales totaled € 2,666.5 million in 2021, an increase of 22.4% or € 488.4 million compared to the previous year (€ 2,178.2 million). Non-operating effects generally had a slightly positive impact on sales development. The aforementioned negative exchange-rate changes resulted in a slight sales decrease of less than 1%. Acquisitions, on the other hand, increased sales by a total of € 28.9 million. The effects were calculated in each case on the basis of the months in which the acquired business belonged to the Group. Of this amount, € 13.0 million related in particular to the acquisition of Henkel’s closure materials business for the ACTEGA division on May 7, 2021, € 7.5 million to the acquisition, back in 2020, of Schmid Rhyner AG in Switzerland for the ACTEGA division, and € 8.3 million to the business activities of TLS Technik GmbH & Co. Spezialpulver KG in Bitterfeld, Germany, acquired for the ECKART division on February 1, 2021. Adjusted for currency and acquisition effects, sales were 21.9% above the prior-year figure.

This not only far exceeded the operating sales growth in the low to mid single-digit percentage range forecast at the beginning of the year for 2021, but was also the strongest sales growth of the past ten years. The upturn that had already begun in the fourth quarter of 2020 picked up considerable momentum in the course of the first quarter of 2021. Overall, historically high capacity utilization and record sales were reported in almost all areas in 2021, so that by the end of 2021 nearly all business areas had already reached or in some cases even significantly exceeded the sales level of 2018. This was mainly achieved by increasing sales volumes, but also by improving the product mix and adjusting selling prices as a result of higher raw material and logistics costs.

The regional sales volume and sales structure shifted only slightly compared to the previous year. With an unchanged share of 39% of total Group sales, Europe remains the most important sales region for ALTANA. The nominal growth of 22%, or 20% in operational terms when adjusted for acquisitions and exchange-rate effects, reflects the global development. Double-digit growth rates were achieved throughout the Eurozone, in the United Kingdom, as well as in the markets in Eastern Europe and Turkey.

In 2021, sales in the Americas were 16% up on the previous year’s figure. Adjusted for negative currency effects, operating growth amounted to 19%. Operating sales in the U.S. increased by 16%, accounting for 17% of total Group sales in 2021 (2020: 18%). All of the other countries in the Americas also reported double-digit growth rates. Mexico achieved the strongest operating growth at 27%, followed by Canada and Brazil. The Americas’ share of total Group sales fell slightly to 26% in 2021 (previous year: 27%).

In the past fiscal year, Asia increased its share of total Group sales from 33% to 34%. In nominal and operating terms, Asia also recorded the highest growth rates within the Group last year (nominal growth 27%, operating growth 26%). This development was mainly driven by China. With a share of 19% of total sales, that country is now ALTANA’s largest single sales market. Operating growth in China amounted to 29%, but was surpassed by India, ALTANA’s second-largest Asian sales market. In India, the company achieved the highest growth in percentage terms with operating growth of 41%. Only the countries of the Middle East showed a decline in operating sales (-6%) compared to the previous year.

Sales Performance of BYK

In the 2021 fiscal year, sales in the BYK division increased by 22% or € 218.5 million to € 1,227.2 million (previous year: € 1,008.7 million). This figure includes negative exchange-rate changes of € - 10.3 million. Adjusted for this effect, operating sales were 23% higher than in the previous year.

The division’s double-digit sales growth in 2021 was uniform across all markets and regions. Following an unexpectedly good fourth quarter of 2020, demand in the subsequent quarters was also at an unprecedented level. Despite a difficult business environment – problems delivering manufacturing materials, bottlenecks in the availability of logistics services, and unexpectedly harsh weather conditions in February in Germany and the U.S. – impressive year-over-year growth was achieved for all product lines. This was primarily reflected in additive sales in the Paints and Plastics product lines, but the other product lines also developed better than forecast.

The regional sales development in 2021 also showed operating growth across all markets on a scale not previously achieved. The strongest sales growth was achieved in Asia, with India, which incurred particularly severe losses in the pandemic year 2020, leading the way in percentage terms with over 50% growth. With the exception of Japan, where operating sales growth was in the high single digits, all other countries in the region, including China, BYK’s second-largest sales market, contributed to the division’s high sales growth with double-digit growth rates. Operating sales in the Americas – mainly influenced by the U.S., BYK’s largest single market – also developed very positively vis-à-vis the previous year. Mexico and Canada led the way, followed by Latin American countries, the U.S., and Brazil. Europe also showed significant operating growth overall. In the Eurozone, Italy in particular made up for the pandemic-related sales declines in 2020, recording operating growth of over 30%, followed by Germany, the strongest country in the region in terms of sales, which grew by 23%.

Sales Performance of ECKART

The ECKART division generated sales of € 382.8 million in 2021 (previous year: € 315.2 million). The year-over-year increase of 21% was slightly negatively influenced by exchange-rate effects and positively influenced by the acquisition of the business activities of TLS Technik GmbH & Co. Spezialpulver KG in Bitterfeld in February of the year. Adjusted for these effects, operating sales increased by 20%. The ECKART division also recovered from the pandemic-related slump in demand in 2020, slightly exceeding its pre-crisis level overall. The recovery was spread across all the industries it supplies, although demand in the automotive industry, partly due to supply bottlenecks in the semiconductor technology sector, has not yet returned to pre-crisis levels. The same applies to the cosmetic applications sector.

The positive sales trend was reflected in all regions in 2021, albeit to varying degrees of intensity. Asia, with China as its strongest sales market, achieved strong growth with the exception of the Middle East. The Americas, which incurred the greatest losses in the previous year, caught up significantly, but were not yet able to return to pre-crisis levels. The highest operating growth was achieved in Europe, both in the Eurozone and in the other markets, and in nominal terms this region even exceeded the pre-crisis level.

Sales Performance of ELANTAS

In the ELANTAS division, sales increased in 2021 by 28% or € 130.3 million to € 593.6 million (previous year: € 463.3 million). The operating sales growth, adjusted for slight positive currency effects, was at the same level. ELANTAS thus achieved the highest operating growth within the Group in year-to-year terms. The division’s very positive development was mainly due to volume increases far above the pre-crisis level. Price adjustments to compensate for material cost increases, which had the greatest impact in this division, also contributed to the sales growth.

A look at the regions shows a continuation of the trend already evident in the previous year. Asia in particular, and especially China, the largest sales market in the region, recorded the strongest sales growth with volume increases far exceeding the pre-crisis level. The Americas, with the U.S. as the most important single market, also recorded high growth rates with double-digit operating sales gains in all countries. As in the previous year, Brazil was particularly noteworthy in this region, continuing to perform consistently well. In Europe, too, the pandemic-related decline of the previous year was more than offset across all markets. In Italy in particular, the largest single market in the region, pre-crisis levels were surpassed by far.

Sales Performance of ACTEGA

With sales of € 462.9 million (previous year: € 391.0 million), the ACTEGA division achieved growth of 18% compared to 2020. The division benefited, among other things, from the acquisition of Swiss Schmid Rhyner AG in February 2020 and the acquisition of Henkel’s closure materials business in May 2021. Adjusted for acquisition and currency effects, ACTEGA achieved operating growth of 15% in 2021. Both the increase in sales volume and price adjustments and positive product mix effects contributed to this result.

All three of the ACTEGA division’s business lines generated growth in 2021 compared to the previous year. Similar to 2020, strong sales growth was achieved above all in the food packaging sector, in which all three business lines are active. Individually, the Paper & Board business line increased operating sales by 14% compared to the previous year. Sales in the Flexible Packaging business line also continued to increase year-on-year in the low double-digit range. The Metal Packaging Solutions business line recorded the most significant increase in sales, mainly due to the acquisition of Henkel’s closure materials business. However, even excluding the new acquisition, operating sales were clearly above the previous year’s level with significant double-digit growth.

The development in 2021 was positive across all regions. In Europe, the largest region, growth in operating terms lagged behind that of the other regions, but was well into double digits. Germany, the largest single market in Europe, recorded solid single-digit growth in operating terms. Most other countries in the region even achieved double-digit growth rates. In the Americas, nominal and operating sales were well above the level of the previous year. In the USA, the largest single market, moderate operating growth in the single-digit range was achieved. In Brazil, operating sales increased by 28%. Asia, still the smallest region, also recorded double-digit sales growth last year – both in nominal and operating terms. The drivers of this positive development were China, with an operating sales increase of more than 40%, and India, with sales up by 30%.

Earnings Situation

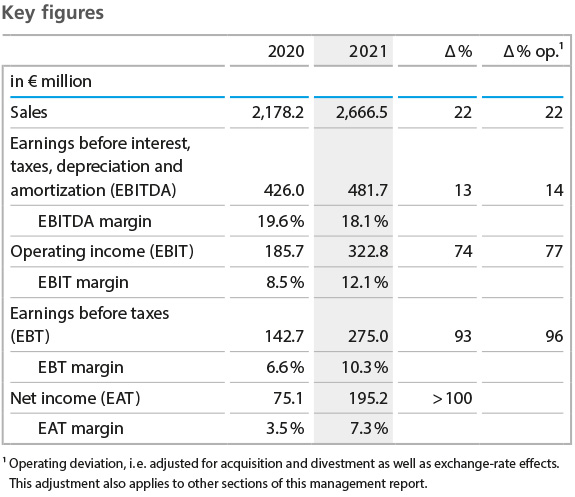

In an environment characterized by exceptionally high demand dynamics and, at the same time, enormous price increases, shortages, and disrupted global supply chains, ALTANA successfully continued its strategy of sustained profitable growth, achieving its highest earnings before interest, taxes, depreciation, and amortization (EBITDA) to date. Compared to the previous year, EBITDA increased by 13% or € 55.8 million to € 481.7 million (previous year: € 426.0 million). Adjusted for acquisition and exchange-rate effects, operating growth amounted to 14%. At 18.1%, the EBITDA margin was below the previous year’s figure of 19.6% due to the substantial increase in purchase costs, but within our strategic target range of 18% to 20%. The price adjustments made to compensate in particular for the increases in material costs played a major role in securing the earnings margin.

The historically high volume growth resulted in an absolute EBITDA figure far surpassing our expectations for 2021 and an EBITDA margin in line with our forecast.

The most important cost parameter for ALTANA, variable raw-material and packaging costs, developed negatively compared to the previous year due to a strong overall increase in raw-material prices. The material usage ratio, the ratio of these costs to sales, increased steadily over the course of 2021 from 41.9% in the fourth quarter of 2020 to 48.2% in the fourth quarter of 2021. For 2021 as a whole, the material usage ratio was 45.4%, significantly higher than the prior-year figure of 41.3% and also higher than we had forecast at the beginning of the year. The increase in the cost of materials affected all four divisions.

In 2021, other cost items developed mainly in line with the positive business performance, high capacity utilization and – due to the high level of demand in the overall economy – the increase in energy and logistics costs in particular. Depreciation and amortization must be considered separately; due to the absence of non-recurring effects from the impairment of goodwill, the overall figure was well below that of the previous year. Adjusted for this effect, depreciation and amortization increased by 3% in a year-to-year comparison. Personnel expenses were impacted by the increase in production capacity and the associated increase in the number of positions, in addition to annual pay rises. Accordingly, personnel expenses rose above the previous year’s figures, which were influenced by the pandemic. The ratio of total personnel costs to sales decreased to 20.9% (previous year: 23.4%) due to the sharp increase in sales. The extraordinary volume growth, high capacity utilization, and higher price levels led to an increase in all operating functional cost areas, particularly in the area of semi-variable production and selling expenses. In addition, there was a significant increase in IT security costs, with additional sums spent on protective and defensive measures against cybercrime in the wake of the increasing threat. All functional areas were affected.

Within production costs, personnel costs in particular were higher than in the previous year due to high capacity utilization. However, increased energy costs, higher maintenance costs, and higher expenses for temporary employees also led to a year-over-year rise.

In terms of selling expenses, the main drivers were freight costs, which accounted for more than half of the cost increase. In second place, the increase in personnel costs, mainly due to the growth in business activities, was also responsible for the increase.

Research and development expenses also rose. In this area, too, the reason for the increase was personnel expenses and higher consulting costs. The ratio of research and development costs to total sales decreased from 7.5% to 6.7% due to the high sales growth in 2021, but remains in line with our target of around 7%.

Administrative expenses increased compared with the previous year. Here, too, the main reasons were higher personnel expenses and consulting costs. However, the ratio of administrative expenses to sales decreased from 4.8% to 4.4%.

The balance of other operating income and expenses improved compared to the previous year due to the discontinuation of the amortization of goodwill at ECKART, which was a significant component of this item in the previous year. Earnings before interest and taxes (EBIT) amounted to € 322.8 million, 77% higher in operational terms than in the previous year (€ 185.7 million).

At € - 2.0 million, the financial result was higher than the previous year’s figure of € -4.2 million. The result of companies accounted for using the at-equity method changed from € -38.9 million in the previous year to € -45.8 million in the 2021 fiscal year. The largest share of this figure relates to our investment in Landa Corporation Ltd.

Earnings before taxes (EBT) increased to € 275.0 million (previous year: € 142.7 million), and earnings after taxes (EAT) to € 195.2 million (previous year: € 75.1 million). The adjusted income tax rate was slightly lower than in the previous year.

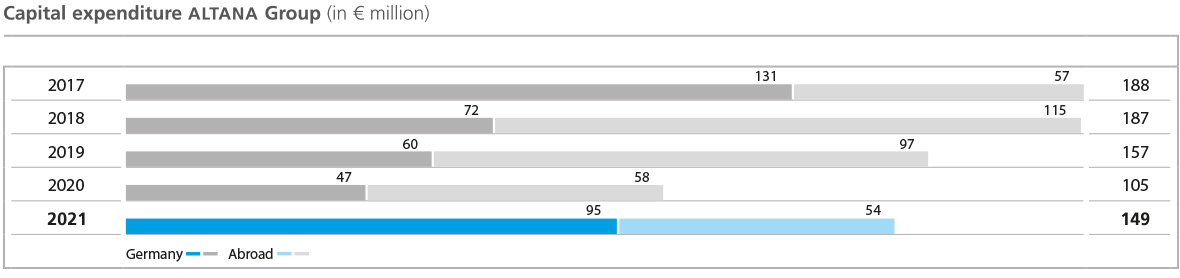

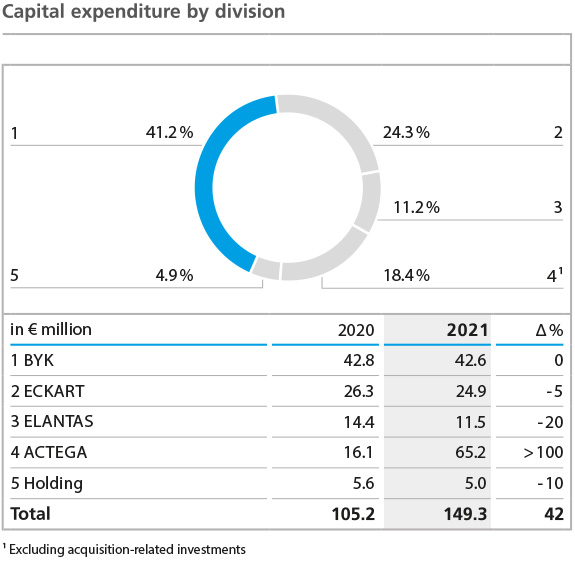

In the past fiscal year, ALTANA invested a total of € 149.3 million in intangible assets and property, plant and equipment. Of this amount, € 46.3 million were spent on acquiring intangible assets and property, plant and equipment in connection with the acquisition of business activities in the ACTEGA division. At € 103.0 million, capital expenditure adjusted for this special item was slightly lower than in the previous year (€ 105.2 million). The adjusted investment ratio, that is the ratio of capital expenditures to sales, at 3.9%, was also below our long-term target range of 5% to 6% due to the high sales growth.

Of the € 103.0 million invested, € 93.5 million (previous year: € 96.3 million) related to property, plant and equipment. For several years, major projects have been carried out to strategically expand global production and laboratory capacities. Investments in intangible assets totaled € 9.5 million in the past fiscal year, compared to € 8.9 million in 2020.

In the regional distribution of investments, there was a project-related shift in favor of Europe vis-à-vis the previous year. While the America’s share decreased from 31% in 2020 to 27% in the reporting year, Europe’s share grew to 61% (2020: 57%). The main focus of investment activity was on Germany (48%) and the U.S. (25%). Asia’s share of the total volume remained unchanged from 2020 at 12%.

The BYK division invested a total of € 42.6 million in 2021, the same level as in the previous year. Investment activity focused on the further expansion of production capacities in Germany and on sites in China. Other investments concerned research and development capacities as well as strategic digitization projects.

At € 24.9 million, the ECKART division’s investment volume was lower than in the previous year (€ 26.3 million). As in 2020, the division’s site in the U.S. and the site in Hartenstein accounted for by far the largest shares.

The ELANTAS division invested less in property, plant and equipment and intangible assets (€ 11.5 million) than in the previous year (€ 14.4 million). In the past fiscal year, the division invested primarily in the production facilities of its European companies.

At € 18.9 million, the ACTEGA division increased its capital expenditure compared to 2020 (€ 16.1 million). Investments in the past fiscal year mainly related to the expansion of manufacturing capacities at German sites.

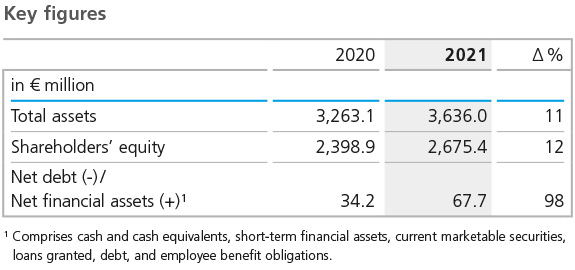

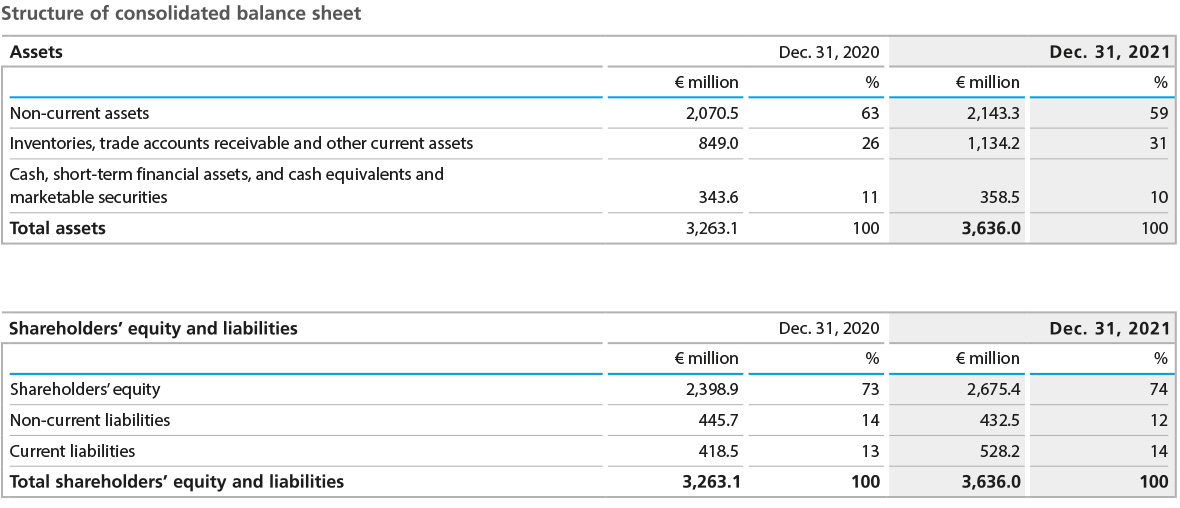

In the course of the 2021 fiscal year, the ALTANA Group’s total assets rose from € 3,263.1 million to € 3,636.0 million. The increase of € 372.9 million or 11% results primarily from an increase in current assets due to the strong growth in operating activities compared to the previous year.

Intangible assets climbed to € 995.3 million (previous year: € 933.1 million), mainly attributable to acquisitions in the ECKART and ACTEGA divisions. Property, plant and equipment also increased slightly in value, developing from € 959.5 million in the previous year to € 997.9 million. With additions of € 93.5 million, the level of investment in property, plant and equipment was below that of depreciation and amortization. Positive exchange-rate effects contributed to an increase in the carrying amounts in the Group currency, the euro, in both areas.

Total non-current assets amounted to € 2,143.3 million at the balance sheet date (previous year: € 2,070.5 million), up € 72.8 million on the previous year. Their share of total assets decreased to 59% (2020: 63%).

The change in current assets was mainly due to the increase in inventories and trade accounts receivable. On the one hand, the value of inventories rose as a result of price increases and, on the other, the volume of inventories was deliberately increased in the second half of 2021 to compensate for supply bottlenecks and to secure the required volumes, particularly in the BYK and ECKART divisions. As a result of the higher sales volume, trade receivables also rose. Due to these effects, net working capital was significantly higher in absolute terms than in the previous year. Inventories increased to € 511.5 million (previous year: € 336.4 million). At € 473.4 million, trade receivables were also higher than in the previous year (2020: € 400.5 million). In the balance with current liabilities, net working capital, at € 737.1 million, was well above the level of 2020 (€ 550.3 million). The scope of net working capital, in relation to the business development in each of the preceding three months, rose to 118 days, compared with 101 days at the end of 2020. Absolute net working capital as well as the scope were thus higher than the figures expected for 2021, as neither the increase in sales nor the supply bottlenecks arising in the course of the year could have been forecast at the beginning of the year. Cash and cash equivalents decreased in the course of the year to € 259.9 million (previous year: € 313.7 million). The decrease is mainly due to money market investments made in 2021 with a contractual term of more than three months and less than one year amounting to € 63.8 million. Total current assets climbed to € 1,492.7 million (previous year: € 1,192.6 million).

On the liabilities side, changes resulted primarily from earnings-related increases in equity, increases in trade payables, and exchange rate-related adjustments. The Group’s equity improved overall by € 276.5 million or 12% to € 2,675.4 million (previous year: € 2,398.9 million). The positive result for the year made a significant contribution to this. At 74%, the equity ratio as of December 31, 2021, was slightly above the previous year’s level (73%).

There was no significant change in total non-current liabilities at the end of 2021. Overall, non-current liabilities decreased by € 13.2 million to € 432.5 million (previous year: € 445.7 million).

However, the total current liabilities reported on the balance sheet as of December 31, 2021, increased from € 418.5 million to € 528.2 million. Owing to the significant increase in business activity and the price increases for energy, freight, and raw materials, trade payables also grew, rising by € 61.3 million to € 247.8 million in the year under review.

The balance of cash and cash equivalents, short-term financial assets, current marketable securities, loans granted, financial liabilities, and employee benefit obligations resulted in net financial assets of € 67.7 million at the balance sheet date of December 31, 2021. This corresponds to an increase of € 33.6 million compared with the previous year.

Principles and Goals of Our Financing Strategy

We generally aim to finance our operating business activities from the cash flow from operating activities. The same applies to the need for capital expenditure, which caters to the continual expansion of business activities.

As a result, our financing strategy is oriented to keeping the cash and cash equivalents generated within the Group centralized. In addition, a financing framework is sought that enables ALTANA to flexibly and quickly carry out acquisitions and even large investment projects beyond the accustomed scope. To successfully implement these goals, we manage nearly all of the Group’s internal financing centrally via ALTANA AG. To this end, cash pools are set up for the important currency areas.

In June 2021, ALTANA restructured its long-term Group financing: Since June 2021, ALTANA has had access to € 250.0 million in the form of a syndicated credit facility from an international bank consortium for the next five to seven years. In addition, ALTANA has had access to loans from the European Investment Bank (EIB) of up to € 200.0 million since the end of June 2021 for the development of climatefriendly, digital, and sustainable products. Neither facility was utilized in the 2021 fiscal year.

This financing structure offers ALTANA the flexibility it needs to appropriately take advantage of short-term or investment-intensive growth opportunities. The distribution of the maturities of the financing instruments we use enables us to optimally control repayment of liabilities with inflows from operating cash flow.

Off-balance-sheet financing instruments result from bank guarantees, purchasing commitments, and guarantees for pension plans. Details on the existing financing instruments are provided in the complete Consolidated Financial Statements.

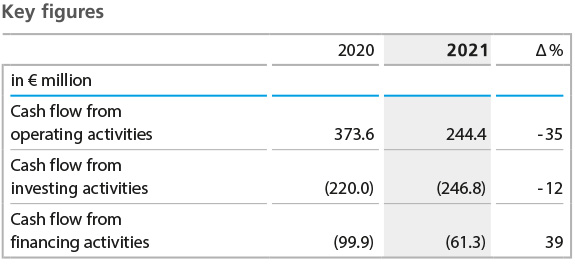

In the course of 2021, cash and cash equivalents decreased by € 53.7 million to € 259.9 million (previous year: € 313.7 million). At € 244.4 million, the cash inflow from operating activities was below the previous year’s level (€ 373.6 million), despite higher consolidated net income. This reflects the high level of capital tied up in net working capital, in particular the sharp rise in inventories.

Cash outflow from investment activities increased in the reporting year to € 246.8 million (previous year: € 220.0 million). The main reason was the increase in the portfolio of current financial assets. Expenditure on acquisitions in 2021 was at a lower level than in 2020 and investments in intangible assets and property, plant and equipment adjusted for acquisitions were at roughly the same level as in 2020.

Cash flow from financing activities amounted to € 61.3 million in the 2021 fiscal year – less than in the previous year (€ 99.9 million). The current debt outflows almost exclusively concerned lease payments. In the 2021 fiscal year, ALTANA AG paid a dividend amounting to € 50.0 million (previous year: € 30.0 million).

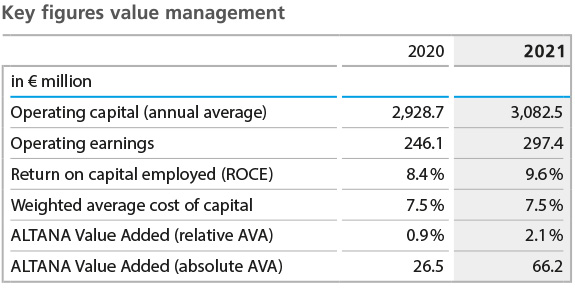

ALTANA determines the change in the company’s value via the key figure ALTANA Value Added (AVA), whose calculation is explained in the “Group Basics” section. In the 2021 fiscal year, thanks to the strong growth in connection with measures to secure profitability and despite challenging framework conditions, a clearly positive contribution to the development of our company’s value was generated, which was significantly higher than in the previous year and exceeded our expectations.

The positive earnings trend is reflected in decisive operating earnings of € 297.4 million (previous year: € 246.1 million). The Group’s average capital employed increased to € 3,082.5 million in 2021 (previous year: € 2,928.7 million). The cost of capital remained unchanged at 7.5%, resulting in a cost of capital of € 231.2 million (previous year: € 219.6 million).

At 9.6%, the return on capital employed (ROCE) significantly exceeded the prior-year figure (8.4%). Absolute value added totaled € 66.2 million in the past fiscal year, compared to € 26.5 million the year before, and relative AVA rose from 0.9% to 2.1% in 2021. The decline in the value management key figures originally forecast for 2021 was avoided due to the very good development of the earnings situation.